Post 2020 our economy has received enormous amount of weird monetary tools, mostly because regular QE wasn’t enough to put us out from economic depression that time. So flood of direct stimulus checks, more QE, BTFP later and probably way way more weird tools which allowed inflation to spike. I must admit MMT was never in my playbook pre 2020. I thought post Feb 2020 market will bounce to certain levels, retest it and tank, but MMT bought us some time.

My base idea of a big cycle is the fact you won’t run away from the problems and The Economy will restore middle class crashed by MMT, QE, BTFP etc. I was pointing to that many times, that to restore middle class leads only through big deflation and it won’t be different IMO this time, because it looks like in 2024 this level is way much higher than it was in 2021.

Something still doesn’t add up here, but look where last time was a reborn of the middle class. More or less 2 decades after 1929. Yes it took 20 years, because in The Economy nothing is for free and changes last decades.

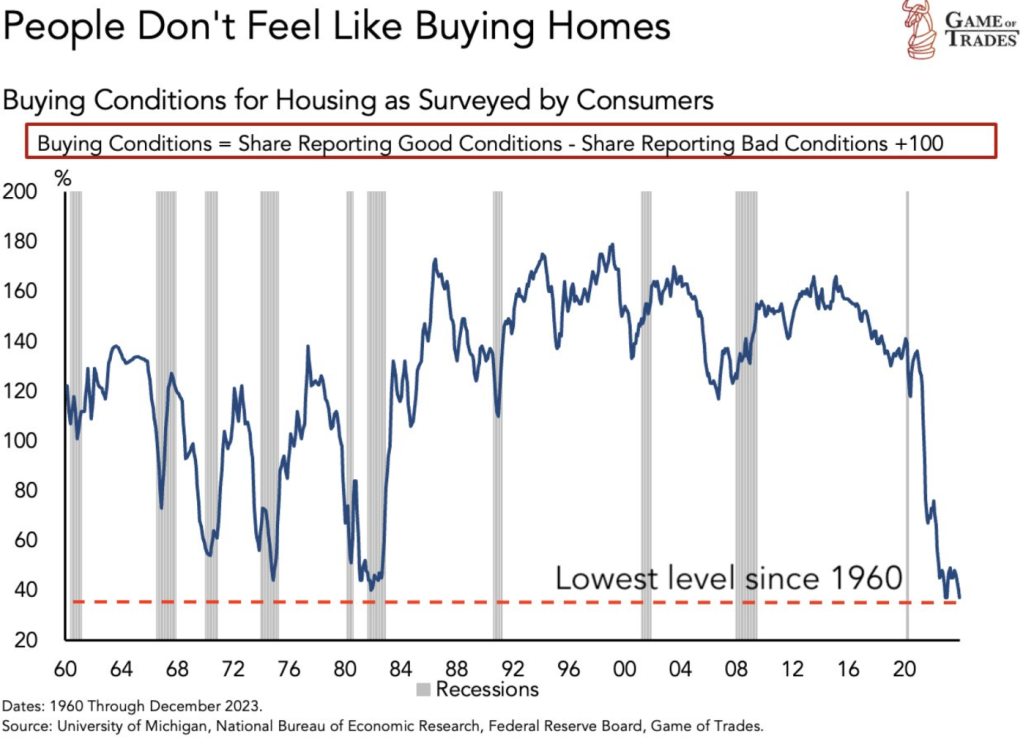

So in reality this inflationary spike turned out to be stagflationary spike. I’m using term spike, because with this level of wealth inequality I don’t think so it’s a permanent state. You won’t find a better example these times are not 1970s, because in 70s you didn’t have inequality and inflation was mostly caused by excessive demand with not sufficient supply. Something it’s not happening these days. You have plenty of choices to buy everything, you want something from China you get it, from France too, from USA too and it’s still the same product, so supply is in excess and it must shrink. Treat this supply example as the amount of restaurants around your home. In 70s you had 5 and everybody wanted to get there. These days you have 100 and soon there won’t be demand on 97 of them.

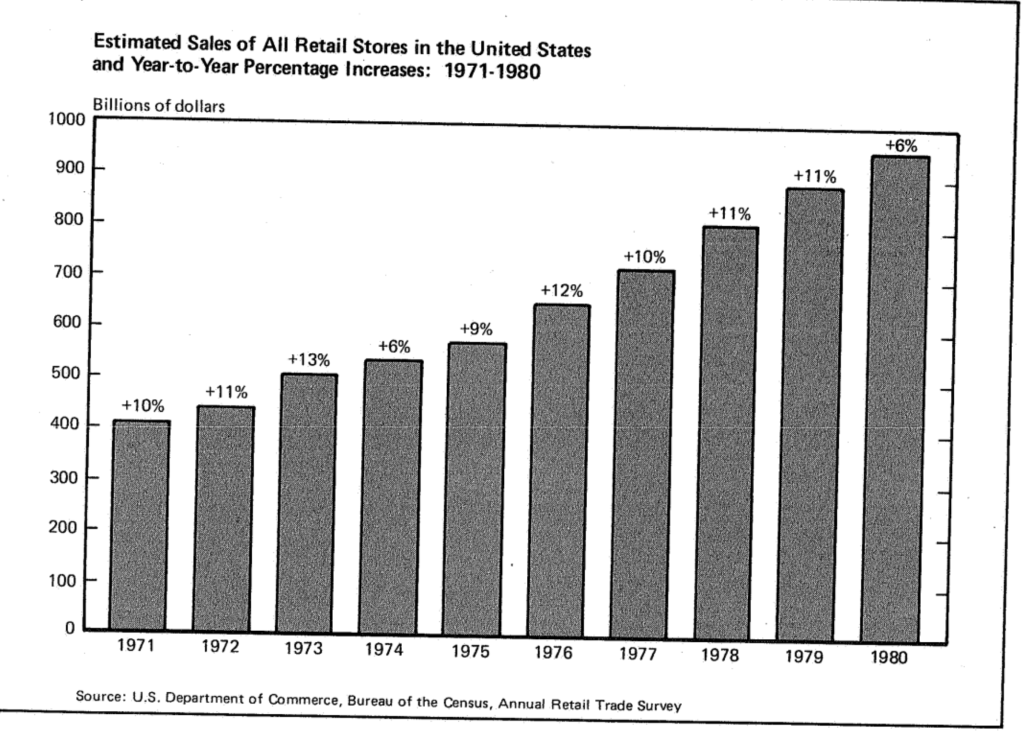

You’re going to see it on this chart below. During all secular stagflationary period retail sales was growing almost +10% YoY! All people wanted to get into those restaurants!

What was the solution in 70s to get more restaurants to cure this demand and increase supply?

The answer is : DEBT (you see it in SUMMER : “Debt builds”). Soaring interest rates in 70s were in reality to tame this demand on restaurants because EQUAL society wanted more. These days MMT achieved some kind of a spike, but it allowed bottom 90% to come to those restaurants 2 additional times and left everybody with a hang-over giving a false impression we need even more restaurants! That’s how we ended up by record invetories nobody wants not to buy without MMT.

So what those MMT tools achieved? In Reality those tools bought a bit of a time at the cost of collapsed demand on almost everything what is not needed in day-to-day live. FED tries tools from SUMMER, which in reality are exacerbating problems in WINTER.

That’s not how people think inflation works. They want inflation from 70s, but … in current times inflation works totally different, what is not suprising looking on wealth inequality chart.

Nobody is surprised here. FED made another mistake. While top 10% believes all is fine, bottom 90% thinks we are in a severe recession and deflation. They’re not WRONG (because even the yield-curve is saying that). We just operate on data I think fixed a bit towards top 10% of society, while leaving bottom 90% without any attention.

But this attention is coming. 80% of jobs belong to small & medium enterprises :

In reality everything FAILED to reignite true real growth. Even if you look at SBO above you see peak was around 2018. Wealth inequality in reality squeezed margins of small business and transfered them towards big companies. Reality is getting hit. Most of them can’t survive, because inflation took care about demand on their products which in reality collapsed and margins are too thin they can survive. There’s also another problem. Today even more than 40% of small businesses looking on Russell 2000 are zombies. These are companies that should have gone bankrupt long time ago, but constant level of liquidity is supporting them, while in reality it’s killing the possibility of a resource transfer towards more productive businesses responsible for killing inflation. You won’t achieve it without deflation.

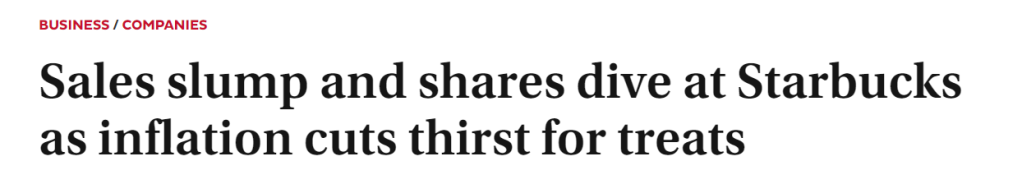

So we achieved a moment where raising inflation on record wealth inequality matters because it turns out without bottom 90% retailers need to drop prices of goods back to 3-5Ys ago to get any meaningful demand. We all know it won’t happen so it’s easy to say there won’t be any demand. Even McDonalds is a luxury brand these days just like Starbucks!

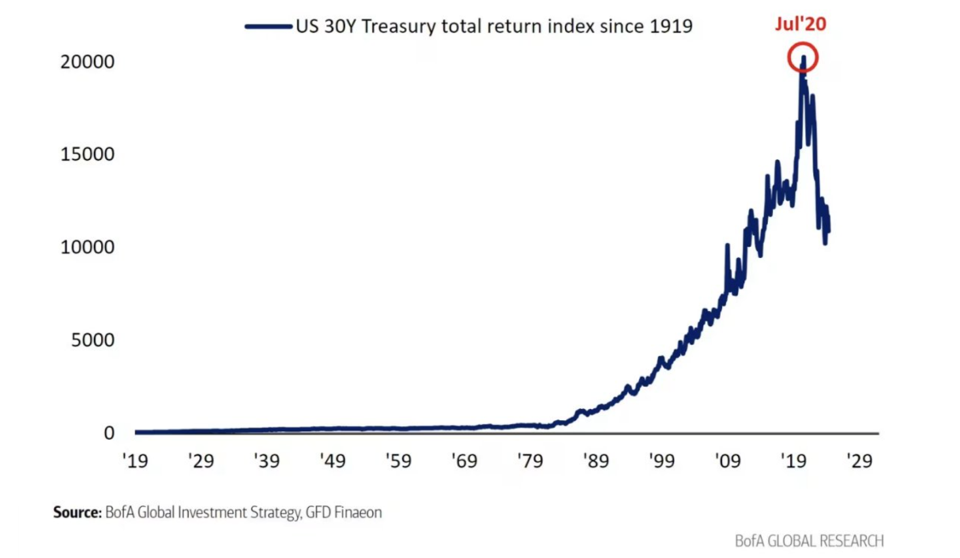

It’s now worth to watch the most hated asset on earth so “The bond market”. The one that recorded record drop in 100Ys. I’m not sure if Central Bankers predicted this type of melt-down, but we all know “direct stimulus checks” in reality are giving more BAD to the economy than GOOD, so I don’t think so any UBI after this experiment will be implemented. Such melt-downs are more and more getting fixed in the economy, and it’s going to be impossible at some point to restore them. I’m not saying McD is going to go bankrupt, but … Starbucks? Why not. It’ll be an example and lesson how cheating the economy ends, as economy needs to close “the big disinflationary cycle by wave of bankruptices to restore productivity and middle class”.

So banks are getting destroyed on this move down in bonds, so the FED invented another tool BTFP to cheat the economy a bit longer, but it had to be turned off too due to certain reasons. Just to make sure. I don’t really believe to resume a full bond bull market at this stage, as MMT imo flipped the cycle from disinflationary to inflationary, but transition will take years or decades. Bond market needs a dead-cat bounce or double-top and IMO that’ll be the last part of the bull market for the bonds. I have two ideas here if we take a look on US02Y :

Red path is my base case. Retest to key trend line around 2.5% and new wave of MMT which will blow everything as inflation will get out of control and everybody will run away from FIAT towards GOLD?

Blue path is not a base case, because it means we’ll flip into economic depression. While in reality I think we’ll follow blue path, I can’t tell it without proper breaking yields back below key trend which is also the same level as (M)MA50 and (M)MA100 confirming this MMT was a spike for an ultimate collapse of the economy.

So the bounce of yields which destroyed the economy post 2020 was created thanks to weird monetary tools thinking about 70s which by definition can’t be materialized. Now this bounce in yields either crash heavily or they’ll invent something around 2.5% on the retest.